What are you looking for?

ClientFirst: 1800 517 124

What are you looking for?

ClientFirst: 1800 517 124

Expand’s tax optimisation tools can help you optimise the capital gains tax (CGT) outcome for your clients and estimate the impact of a trade before it is submitted:

Choose from three tax optimisations methods to help you manage your client’s CGT outcomes:

*Lowest / highest gains are calculated after applying CGT discount rates (for parcels held for more than 12 months).

The tax optimisation methods can be accessed via the Account details tab or when loading a trade from the Investments tab.

+0923+Tax+optimisation+images+for+myexpand+website_743px_300_V1b.jpg)

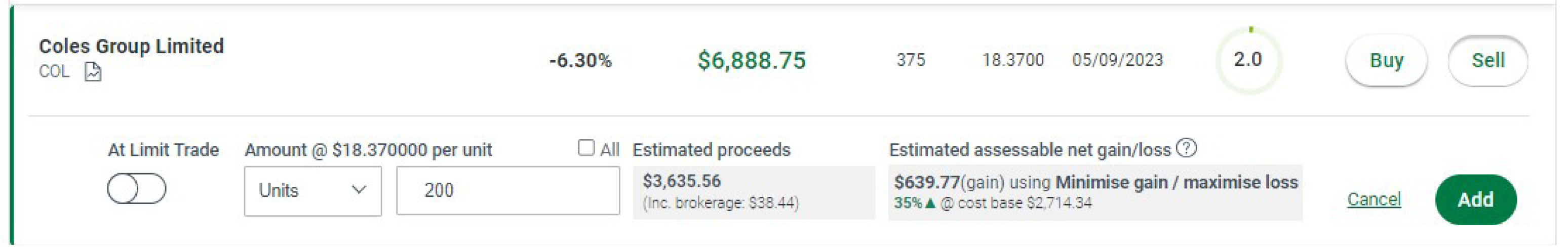

Our on-screen estimate of the assessable net gain/loss of a trade allows you to see the impact of a trade before it is submitted.

The estimate is calculated in real time based on the:

This estimate also includes a CGT discount where the account type is eligible and the parcel selected has been held for over 12 months. The estimate is calculated using current balances at the time of trade, it does not consider any pending transactions, off platform assets or gains/ losses from other transactions.

Tax optimisation method

On-screen estimation

EXPERIENCE EXPAND TODAY

Where big tech meets personal support, our team is committed to partnering with advisers to understand your needs and provide valuable support.