Lean yet mighty.

Contact us

What are you looking for?

ClientFirst: 1800 517 124

Expand Essential & Essential +

A low-cost super, pension and investment wrap designed for clients with simpler needs.

Access ready-made multi-manager solutions and highly rated SMAs managed by the award-winning MLC Asset Management. Plus access the Essential+ investment menu including ETFs and term deposits. All with a choice of insurance options.

Expand’s intuitive platform streamlines advice implementation with fast, paperless processes and easy account management.

Lower costs to serve with a flat admin fee, helping you reach more clients efficiently.

Deliver clarity and transparency through Expand’s client app and online reporting tools.

HIGHLY RATED PRODUCTS AND RECOMMENDED PLATFORM

Expand is rated 5 Apples a ‘Highly Recommended platform’ by Chant West.

Expand Essential Super

Expand Essential is ranked #1 for BDM Support and #1 for Admin Support in the 2025 Wealth Insights Report.

Read more about the Chant West ratings or The Heron Partnership ratings.

LOW-COST ADMINISTRATION FEES

| Account balance | Investment Menu | |

|---|---|---|

| Essential[1] | Essential+ | |

| First $500,000 | 0.10% | 0.20% |

| Next $300,000 | 0.10% | 0.10% |

| Above $800,000 | Nil | Nil |

| Maximum Administration fee (excluding Account Keeping Fee) | $800 p.a. | $1,300 p.a. |

| Account Keeping Fee | $78 p.a. | |

| Interest retained on Cash Account | 0.50% - 1.40% | |

| Administration costs paid from the reserve | 0 – 0.04% | |

[1] Includes the Cash Account balance.

INVESTMENT OPTIONS

Choose from our range of multi-manager options, managed by our award-winning MLC Investment Asset team.

Our low-cost range of blended index and active multi-manager funds.

Our value range of predominately active multi-manager funds, where our experienced investment team uses extensive market research to manage the portfolios.

A range of low-cost funds with diversified investment solutions, that are active where it matters most.

Targets returns above inflation while managing market uncertainty.

Active single sector funds you can blend into clients’ portfolios to suit their risk profile and needs.

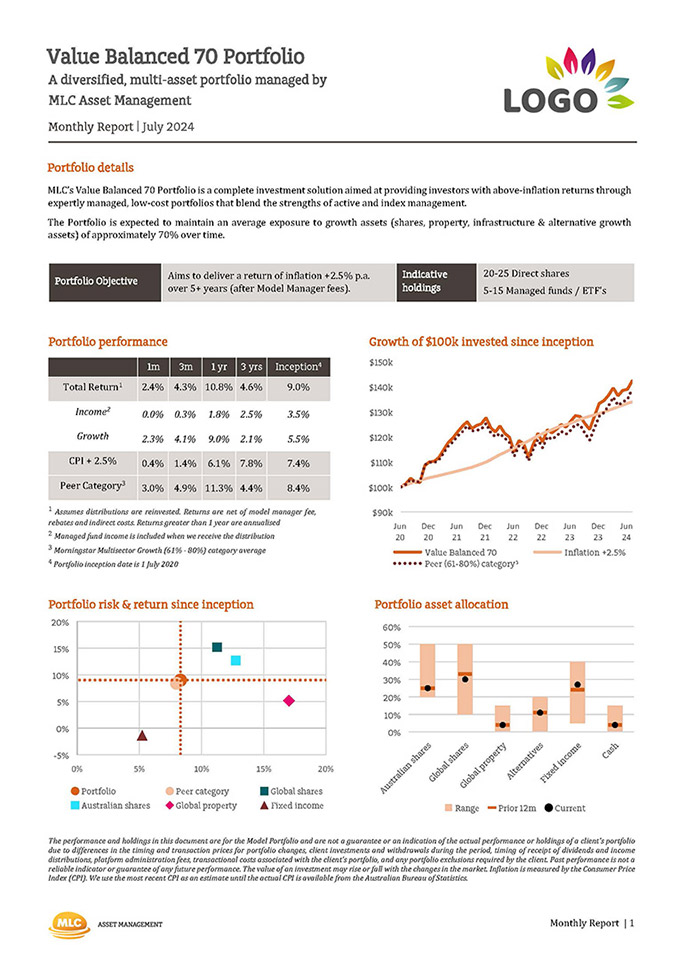

Focused on providing above-inflation returns by blending the strengths of active and index management that’s diversified across asset classes.

Focused on providing above-inflation returns through active management that’s diversified across asset classes, specialist investment managers and stocks.

Choose from a range of term deposits and exchange traded funds from our Essential+ investment menu which complements our existing Essential investment menu above.

Choose from a range of exchange traded funds from leading providers including Betashares, BlackRock and Vanguard.

INTRODUCING ESSENTIAL+

The Essential+ investment menu provides access to a range of Term Deposits (TDs) and Exchange Traded Funds (ETFs) via Expand Essential to complement our existing suite of MLC managed funds and SMA model portfolios.

Request a demoINTRODUCTION TO INVESTMENT CENTRAL

Investment central

A powerful online tool that allows you to run client reports with your business branding to show case your investment expertise and provide clients with full portfolio transparency.

Request a demo or watch this video to learn more.

Talk to us today

Where big tech meets personal support, our team is committed to partnering with advisers to understand your needs and provide valuable support.